Have you ever wondered whether mirror trading could ever be tied to money laundering in finance? It is a practice whereby a trader mirrors the trades of another on the opposite side of the market so that one trader copies another’s trades into their market. One could say that it is a fairly simple investment strategy that begs the question of financial crime when looking through the lens of anti-money laundering (AML) rules.

Anti-money laundering (AML) laws are in place to deter criminals from concealing money that they earned through crime. It’s important to note the connection here because mirror trading is one method of getting around these laws. This article will explore the role that mirror trading plays in money laundering and what traders can do to avoid it being used against them.

Mirror Trading

This is the path investors take to seek additional rewards by shadowing the performance of a different trader. You’re watching someone’s moves, and you’re copying them on your account.

So any type of financial market can encounter this, be it stocks, crypto, etc. Mirror trading in money laundering replicates the process of professional traders in which good winners are adapted to a successful strategy and then used in the hope of a certain financial benefit. It is used accordingly, such as mirror trading crypto and even at major financial institutions like Deutsche Bank.

Bonus: Read about mirror trading strategies and AML practices, and find the latest resources and expert advice.

Understand the Anti-Money Laundering in MR

Anti-money laundering (AML) laws are crucial in the financial world to prevent drug money or stolen funds from being washed through real life systems.

AML stands for anti-money laundering, and its practices track the origin of funds to avoid its use for unauthorized activities. Mirror trading must comply with AML practices that try to circumvent any money laundering risk. These laws ensure that mirror trading is not abused to conceal dirty money.

How Mirror Trading in Finance Works?

In finance, mirror trading is where a second shareholder emulates the full trading activity of another trader. This may be done either manually or automated by systems that implement some specific strategies. You also see mirror trading in the cryptocurrency market and casinos as well, where launders mirror to copy the winning pattern of successful crypto traders.

Others do it for long-term growth, but some investors implement a mirror trading strategy to earn quick profits. However, knowing how these strategies can be prevented from being used for illegal purposes is critical when linked to mirror trading in AML practices, with major firms such as Deutsche Bank participating in it.

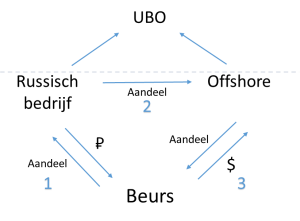

Relation between Mirror Trading and Money Laundering

This relation helps make it easier for people to disguise illegal money by making it look like a legal trade. The risk is higher in areas such as mirror trading crypto, where transactions may be more difficult to track.

Why is Mirror Trading used for Money Laundering?

In certain mirror trading situations, such as when an individual copies a high value trade, money may be exchanged between accounts or borders without drawing red flags.

This scheme helps to make criminal transactions challenging for authorities to trace. The anonymity and speed of mirror trading make it a tempting option to conceal illicit gains when abused.

Detect Mirror Trading in AML Practices

Mirror trading has passed the AML detection up. Mirror trading is when traders mimic each other’s moves, allowing suspicious activities to be concealed.

Governments employ a range of mechanisms to identify suspicious activity indicative of money laundering. They enable the detection of forms of mirror trading strategies designed to mask illegal trades by monitoring large volumes of matching trades with other trades.

How to Prevent Mirror Trading Abuse?

Banks and trading platforms should establish stringent monitoring systems to identify suspicious transactions that may suggest unlawful conduct. For instance, firms could be forced to report unusual trading patterns. Other financial institutions, like mirror trading Deutsche Bank, have been scrutinized in the past over the practice of mirror trading, which also circumvents anti-money laundering (AML) controls.

Through compliance measures, regular audits and reporting suspicious transactions, the financial institutions mitigate these measures to ensure that all mirror trading, including mirror trading crypto, is conducted transparently and legally.

Mirror trading may be a beneficial technique. However, it is also a very high risk when associated with money laundering. Click here to read more about mirror trading, especially in crypto, to prevent your investments from being part of money laundering.